Indicators on Tax You Should Know

Wiki Article

How Tax Amnesty can Save You Time, Stress, and Money.

Table of ContentsGetting My Tax As Distinguished From License Fee To WorkThe Best Guide To TaxonomyThe Ultimate Guide To Tax Avoidance And Tax EvasionTax Amnesty Fundamentals ExplainedTax Amnesty 2021 Can Be Fun For AnyoneThe 4-Minute Rule for Tax AmnestyUnknown Facts About Tax Amnesty

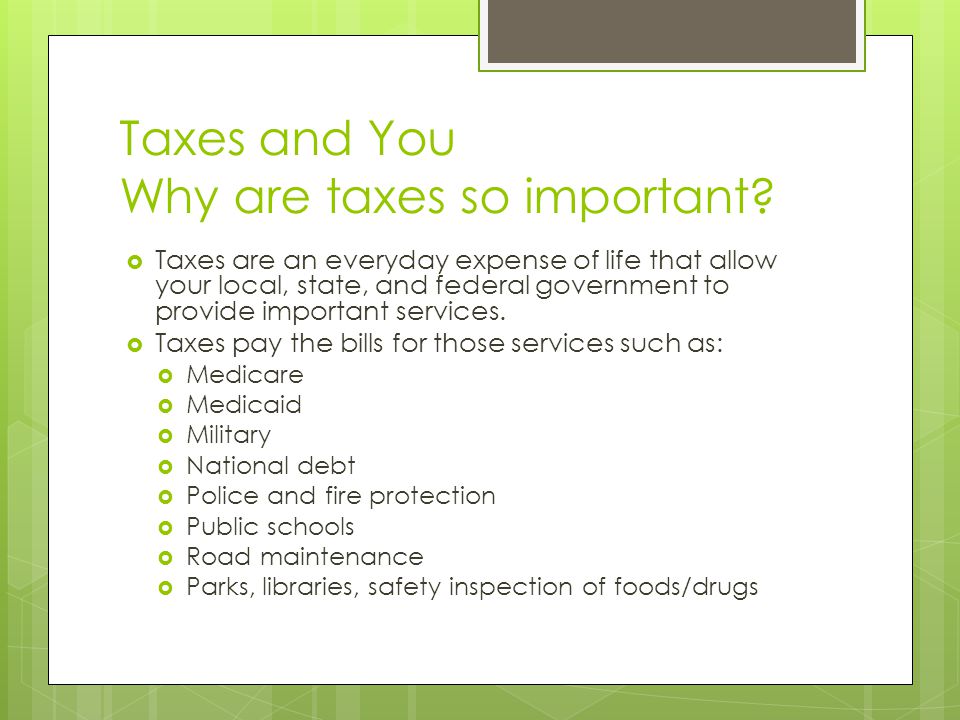

Additional Reading, For more on earnings tax, see this Northwestern Regulation School article and this College of Chicago Law Review write-up.Intro Throughout background, every organized culture had some kind of government. In complimentary cultures, the goals of federal government have actually been to shield individual liberties and also to promote the health of society as a whole. To satisfy their expenses, federal government demand revenue, called "earnings," which it raises via taxes. In our nation, governments impose several different sorts of taxes on people as well as businesses.

What Does Tax Avoidance Meaning Do?

The capitalism system does not produce all the services needed by society. Some solutions are more successfully offered when federal government firms plan as well as administer them. Two excellent instances are national protection as well as state or local police protection. Everybody gain from these services, and also one of the most practical means to spend for them is with tax obligations, rather than a system of solution costs.There are additionally policies to manage such points as the use of signboards and also signs along freeways. The free business system is based on competitors amongst businesses.

To ensure that a level of competitors exists, the Federal Government imposes strict "antitrust" legislations to avoid anybody from getting syndicate control over a market. Some services, referred to as "natural syndicates," are extra efficiently offered when there is competitors - tax amnesty. The best-known examples are the utility business, which supply water, gas, and also power for home and company use.

The Buzz on Tax Amnesty 2021

The capitalism system assumes that customers are well-informed concerning the high quality or security of what they acquire. In our modern-day society, it is commonly difficult for consumers to make informed options. For public defense, government companies at the Federal, State, as well as local levels problem and also enforce regulations. There are policies to cover the top quality and safety and security of such things as house construction, cars and trucks, and also electric appliances.

One more crucial kind of consumer security is the usage of licenses to avoid unqualified people from operating in specific areas, such as medicine or the building trades. Our kids obtain their education mainly at public cost. City and also area federal governments have the primary responsibility for elementary and additional education and learning. The majority of states sustain colleges and also colleges.

Federal grants made use of for performing study are an essential source of money for schools. Considering that the 1930s, the Federal Federal government has been supplying earnings or services, typically called a "safeguard," for those in demand. Major programs include health and wellness services for the senior and also financial help for the disabled and also jobless.

Some Known Questions About Tax Avoidance And Tax Evasion.

Tax obligations in the USA Governments pay for these services through profits acquired by exhausting 3 financial bases: revenue, intake and Get the facts wealth. The Federal Government taxes income as its main source of revenue. State governments use taxes on income as well as usage, while regional governments depend nearly completely on tiring residential property and also wealth.The individual earnings tax generates regarding five times as much earnings as the business income tax obligation. Not all income tax strained in the exact same way.

Comparative, the interest they gain on money in a normal interest-bearing account obtains included with incomes, incomes as well as other "regular" revenue. tax avoidance meaning. There are likewise several sorts of tax-exempt and tax-deferred cost savings intends available that effect on people's taxes. Pay-roll tax obligations are a crucial resource of revenue for the Federal Federal government.

The Definitive Guide to Tax Accounting

Staff members additionally pay into the social safety and security program via money withheld from their incomes. Some state governments additionally utilize payroll taxes to spend for the state's joblessness settlement programs. For many years, the quantity paid in social safety and security tax obligations has greatly raised. This is since there are less workers paying into the system for each and every retired person more helpful hints currently receiving advantages.Taxes on Usage The most crucial tax obligations on intake are sales and also import tax taxes. Sales taxes normally obtain paid on such points as automobiles, apparel and film tickets.

Examples of products based on Federal import tax tax obligations are heavy tires, fishing devices, aircraft tickets, fuel, beer and also alcohol, weapons, and also cigarettes. The purpose of import tax taxes is to position the concern of paying the tax on the customer. An excellent instance of this use import tax tax obligations is the fuel excise tax obligation.

The 8-Minute Rule for Tax Amnesty Meaning

Only individuals that buy gas-- who make use of the freeways-- pay the tax. Some products obtain taxed to dissuade their usage. This puts on excise taxes on alcohol and tobacco. Import tax tax obligations are also utilized throughout a battle or nationwide emergency situation. By elevating the cost of scarce products, the federal government can minimize the demand for these items.A lot of regions tax obligation private homes, land, and organization property based on the building's worth. Usually, the taxes make money monthly along with the mortgage payment. The one who holds the mortgage, such as a financial institution, holds the cash in an "escrow" account. Settlements after that obtain made for the property owner.

Some Known Details About Tax As Distinguished From License Fee

Taxpayers might deduct a specific amount on their tax returns for each allowed "exception." By lowering one's taxable earnings, these exceptions as important link well as reductions sustain the standard concept of taxing according to capability to pay. Those with high taxable earnings pay a bigger percent of their earnings in tax obligations. This percent is the "tax rate." Considering that those with greater taxable earnings pay a higher portion, the Federal earnings tax is a "modern" tax.Report this wiki page